Today Mr. Topf, our client, told us that he wanted to invest on sustainable, socially, conscious, mission, green, ethical company therefore our project had to focus on "Socially Responsible Investing".

The past week has given us the opportunity to explore and learn independently about finance. Now that we know more about the unit and the different terminology and what the client wants exactly it is easier to create the proposal and presentation.

Today I learned the exact needs of my client which are:

1. Socially Responsible Investment

2. Invest in:

Stock#1: Great place to work & values its employes

Sources: Forbes and Bloomberg

Stocks#2: Alternative Energy

Stock#3: Innovative products that make our lives better and does social good

Stock#4: A company you admire and respect

3. More than 10% of return on investment

4. Companies and sectors that are innovate

After understanding our client my group and I divided the tasks(each one do a stock) to then conquer.

I was looking at Starbucks and Whole Foods which are ranked good places to work in and also have a steady increment of growth in the market.

Today we also learned how to read some basic information of stocks.

Market Capitalization

-Number of shares * price per share

-How much shares they have in the market and how much they are worth?

Earnings per Share (EPS)

-Suggests that investors are expecting higher earnings growth in the future compared to companies with a lower P/E

-The lower the P/E the more revenue the company will have

-Higher the P/E the more volatile Volume

-How many stocks are bought and sold -Yield; dividends- return in investment

-Volatile- because the stock goes up in a short amount of time

-Companies who are sustainable and reliable are more likely to have a steady chart

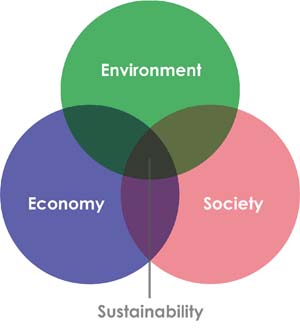

Finally we learned about the triple bottom line which refers to having profit in the bottom line, least importance. (1. PEOPLE 2. Planet 3.Profit)

The past week has given us the opportunity to explore and learn independently about finance. Now that we know more about the unit and the different terminology and what the client wants exactly it is easier to create the proposal and presentation.

Today I learned the exact needs of my client which are:

1. Socially Responsible Investment

2. Invest in:

Stock#1: Great place to work & values its employes

Sources: Forbes and Bloomberg

Stocks#2: Alternative Energy

Stock#3: Innovative products that make our lives better and does social good

Stock#4: A company you admire and respect

3. More than 10% of return on investment

4. Companies and sectors that are innovate

After understanding our client my group and I divided the tasks(each one do a stock) to then conquer.

I was looking at Starbucks and Whole Foods which are ranked good places to work in and also have a steady increment of growth in the market.

Today we also learned how to read some basic information of stocks.

Market Capitalization

-Number of shares * price per share

-How much shares they have in the market and how much they are worth?

Earnings per Share (EPS)

-Suggests that investors are expecting higher earnings growth in the future compared to companies with a lower P/E

-The lower the P/E the more revenue the company will have

-Higher the P/E the more volatile Volume

-How many stocks are bought and sold -Yield; dividends- return in investment

-Volatile- because the stock goes up in a short amount of time

-Companies who are sustainable and reliable are more likely to have a steady chart

Finally we learned about the triple bottom line which refers to having profit in the bottom line, least importance. (1. PEOPLE 2. Planet 3.Profit)

RSS Feed

RSS Feed