When you are about to buy a stock or a company, hire an employee, choose a bank to deposit your money, or even donate to an NGO you look for information about them that gives you enough detail to TRUST them. You want to buy a stock that will perform great in the future, so you can have an amazing return. You want to buy a company that is financially stable. You want to hire an employee that has a professional background. You want to deposit your money in a bank that measures carefully its risks and manages well the money. Finally, you want to donate to an NGO that is using its fund properly and making a change. Every bit of information you collect about a company matters. It matters because the more you know it, the more likely you are to TRUST on it. The most TRANSPARENT institutions and people are the ones who gain their clients TRUST first.

There is a stereotype that banks aren’t friendly, they INTIMIDATE. In Peru, many people living in the lowest secret of the economy don’t have access to the financial system. In many cases, this is related to their economical background, but mainly most of them don’t TRUST these HUGE institutions to watch their money. So, what do they do? They put away their savings under their mattress and hope for the best. One of the things that has contributed to this stereotype is the fact that banks are too complex, the information they give out is too hard to understand and we want S I M P L E. We want simple because if we don't understand the information given, how can we TRUST?. Another thing that greatly impacts many people’s and corporations CHOICE of bank is the fact that they are AWARE of how this institution is performing, if it’s stable, and how it's handling its money. Therefore, TRANSPARENCY is the vital ingredient for TRUST.

When companies are TRANSPARENT with their customers, meaning they also share information when they are having trouble, the client feels CONFIDENT about the institution as nothing is held back hidden; thus, they gain more TRUST and stay true to the business, they buy more products and continue building a relationship with the bank. It’s like a certification that no information is being manipulated and the right decisions, with the money placement, are being done well. TRANSPARENCY is the new ingredient to compete in the market, is the new guarantee of TRUST. So even though it’s hard to stay TRANSPARENT, because there is always that dentition to hide some things, it does bring advantages in the long run.

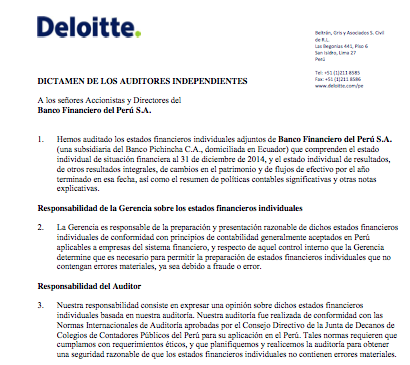

Every year, an external corporation like Deloitte, makes an INTERNAL audit for the bank, which confirms that everything they document in the papers they file to SUNAT are TRUE. Banks are extremely regulated because they lend money from the public; however, the idea of having regulators isn’t enough for an individual or a corporation, there is nothing like beign a primary source. Clients want ALL the cards in the table that display how the bank has performed, by seeing it with their own eyes and analyzing the data they can FEEL more confident about the decision they've made with the bank. After the bank undergoes the audit, this document is PUBLISHED on the SUNAT website, so anyone who want so see how the bank has performed over the years can.

In our own company, Blendz, we’ve implemented TRANSPARENCY in our culture because we see the value in it. We are very TRANSPARENT with our finances, in our website we have published the financial status of all the sales, so our clients can see how much money we've made and how the 100% of the profit goes to Habla Roosevelt. Now, people who doubted our S/.8 price can be sure that we don’t keep anything in our pockets, and the money is used RESPONSIBLY. Even though Habla Roosevlet takes place during Saturday’s when there is no school and anyone can’t see it, we constantly put updates and pictures of how things are going. We want to display the change our company is making because it’s important that our clients see that every smoothie makes a CHANGE. Something we could work on, is creating a detailed balance sheet and posting it on the website or Facebook page, this is a clear way to see where we are going financially. Additionally, by keeping our finances in public, it builds HUGE amounts of trust in the clients, which makes them want to keep buying. Now they know their purchase is worth it. Furthermore, we’ve also been very transparent with our recipes, the magnificent Berry-B or classic Banorange are no HIDDEN treasures. If you want to drink one at home the recipes are posted online. We still need to advertise this much more to our customers, but they are posted. We not only share each ingredient that goes in our smoothies, but also every calorie as well.

On the other side, being TRANSPARENT also has it’s down falls and things we need to CHALLENGE. Especially in banks transparency is COMPLICATED. They display complex information that maybe misinterpreted by the clients as they are not familiar with the terms or balance sheets and the numbers look scary, information can be misread. Also, if you put your information out to the public it's most likely that the COMPETITION will use this to their advantage and eventually pass you. Finally, there is always that hard BALANCE between showcasing some information, and also keeping the some of it private. It’s hard to do this because it may seem that you are hiding something, but banks do need to manage this balance because they work with confidential information from their clients.

Nonetheless, if we take into account the benefits and challenges TRANSPARENCY has I’d agree that being transparent creates a TRUSTWORTHIER environment, and it's pros surpass the cons. It gives clients relief that their money is being held in great hands and makes them LOYAL to you. It also brings trust amongst corporations, stakeholders, and even with your own employees. This is a great tool to attack the competitive market and bring together a community that TRUST you and will make you GROW.

RSS Feed

RSS Feed